For the past few years, artificial intelligence (AI) stocks have been propelling the overall market upward, and although there are plenty of excellent options available at present, there’s an overlooked AI stock that many investors may not be paying attention to: Docusign (NASDAQ: DOCU) It has increased by 51% over the last year, yet it’s still trading at 72% less than its peak value in 2021, indicating significant potential for additional growth.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed their thoughts on what they consider to be the top choices. 10 best stocks to buy right now. Learn More »

DocuSign stands out as a frontrunner in digital document solutions, streamlining business processes throughout the entire contract lifecycle. Artificial intelligence has become integral to its range of products. Currently, the stock appears undervalued considering the consistent revenue expansion and significant increase in profitability for the fiscal year ending January 31, 2025. This makes it potentially an excellent choice for long-term investment.

Transforming contract management using AI

DocuSign was a trailblazer in electronic signature technology before broadening its range of products to encompass various tools designed to assist companies in drafting, negotiating, and finalizing deals online.

However, last year, the firm revamped its approach by introducing a fresh platform centered around artificial intelligence named Intelligent Agreement Management (IAM). This system aims to address what’s known as the "agreement trap." According to Deloitte, this issue causes companies to forfeit approximately $2 trillion annually due to inefficient contract management processes.

The platform comes with a set of cutting-edge features. AI-powered Products such as Navigator serve as a digital archive where companies can keep all their contracts. This system pulls out key information from each agreement, enabling staff members to locate what they need via searches instead of sifting through documents one by one. According to DocuSign, an average IAM client uploads more than 4,000 agreements into Navigator, thereby greatly cutting down on paperwork and administrative tasks.

Maestro ties the IAM platform together. It's a no-code tool that allows businesses to easily create agreement workflows. For example, they can drag-and-drop features like eSignature, ID verification, and webforms into each contract, saving time and money while creating a smoother user experience for all parties in the process. Docusign says one customer, Metro Credit Union, is saving over 50 hours per month thanks to Maestro, because it reduces the amount of time required to process payment forms from five minutes to just seconds.

IAM has only been live for two quarters, and during the final quarter of fiscal 2025, Docusign said the platform already accounted for more than 20% of new customer deals, so it's quickly generating traction.

Docusign's profits soared in fiscal 2025

Docusign generated a record $2.98 billion in revenue during fiscal 2025. It represented a modest growth rate of 8% compared to the previous year, but it was slightly above management's guidance of $2.96 billion.

The business might be expanding at a faster pace; however, it is choosing to meticulously control its expenses to enhance profitability. Actually, the firm’s overall cost management is quite deliberate. operating expenses was recorded as $2.15 billion during the fiscal year 2025, which was down marginally lower than the previous year, which entailed a decrease in expenditure for growth-focused initiatives such as advertising.

As income increased and expenses decreased, DocuSign achieved a record of $1.06 billion. net income , representing a staggering 1,343% increase compared to the previous year. That being said, decreased expenditures were not the sole factor behind this impressive outcome, as the firm also benefited from a one-time tax advantage amounting to $819 million.

Nevertheless, Docusign still produced $747.2 million in net income. non-GAAP (on an adjusted basis, this removes that tax advantage (though it similarly omits non-cash expenses such as stock-based compensation This represents an increase of 19.8% compared to fiscal year 2024, so regardless of how investors look at it, the company's final financial outcomes are definitely moving in the correct direction.

The Docusign stock appears to be a solid investment opportunity.

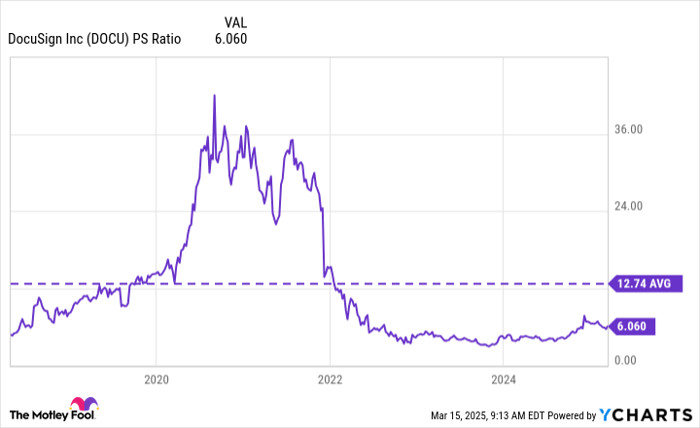

As noted previously, the Docusign stock price has dropped by 72% from its peak, recorded during the technology boom of 2021. At present, it is being traded at a price-to-sales (P/S) ratio of around 40 at its peak, which was an unsustainable valuation, especially because the company couldn't maintain its rapid revenue growth from the pandemic period.

Based on Docusign's fiscal 2025 revenue, its stock now trades at a more reasonable P/S ratio of just 6.1, which is a 52% discount to its long-term average of 12.7 dating back to when it went public in 2018:

In simpler terms, DocuSign’s stock price needs to increase by over two times merely to align with its historical average Price-to-Sales ratio. This doesn’t mean such an event will occur shortly since the firm likely requires consistent expansion in revenue growth to persuade investors to invest at higher valuations, which hasn’t been observed recently. Nonetheless, DocuSign estimates its potential market size at $50 billion, indicating they’ve only begun to tap into their opportunities.

DocuSign is also appealing due to its price-to-earnings (P/E) ratio at only 16.9, making it much more affordable than theصند możliwo Nasdaq-100 The technology index has a P/E ratio of 28.5. Nonetheless, when using non-GAAP figures, DocuSign’s P/E ratio stands at 24.1. earnings Starting from fiscal 2025, which could provide a more accurate representation of the current situation as it excludes the significant tax advantage the company leveraged last year. Nonetheless, that still lowers the price of the stock compared to the Nasdaq-100.

Consequently, I believe DocuSign's stock has the potential to extend its 51% growth from the last year and keep moving towards its historic peak of $310 in the foreseeable future.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on investing in some of the top-performing stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $309,972 !*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $40,573 !*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $512,338 !*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

Continue »

*Stock Advisor returns as of March 18, 2025

Anthony Di Pizio does not hold any shares in the companies listed above. However, The Motley Fool has investments in and endorses Docusign. The Motley Fool holds a position in Docusign. disclosure policy .

Post a Comment